Case Study

Pizza Hut Digital · Product Designer · 2025-Present

B2C | Product-discovery

Bring your own device: Bringing restaurants on to the core platform offering

TL:DR

New experience layer scoped

Data-informed decisioning

High-level design

Product scoping

Context

The project and my role within it

Overview…

As Design Lead within the Discovery Squad, I led the scoping, definition, and high-level design of a new BYOD commerce channel for Pizza Hut’s dine-in experience layer.

Objectives

Why was design input needed?

Design challenge…

To equip restaurants with a digital ordering solution that maximises the e-commerce platform and creates a seamless, cross-channel experience for customers.

The reality…

With restaurants currently using third-party software solutions for their dine-in experiences, the brand aesthetic and loyalty offering was compromised and dis-jointed.

The goal…

To bridge the gap between online ordering and the dine-in digital experience by providing a seamless customer journey that simultaneously drives operational efficiency for restaurants.

Analysing: The existing experience

What did the current third-party experience offer?

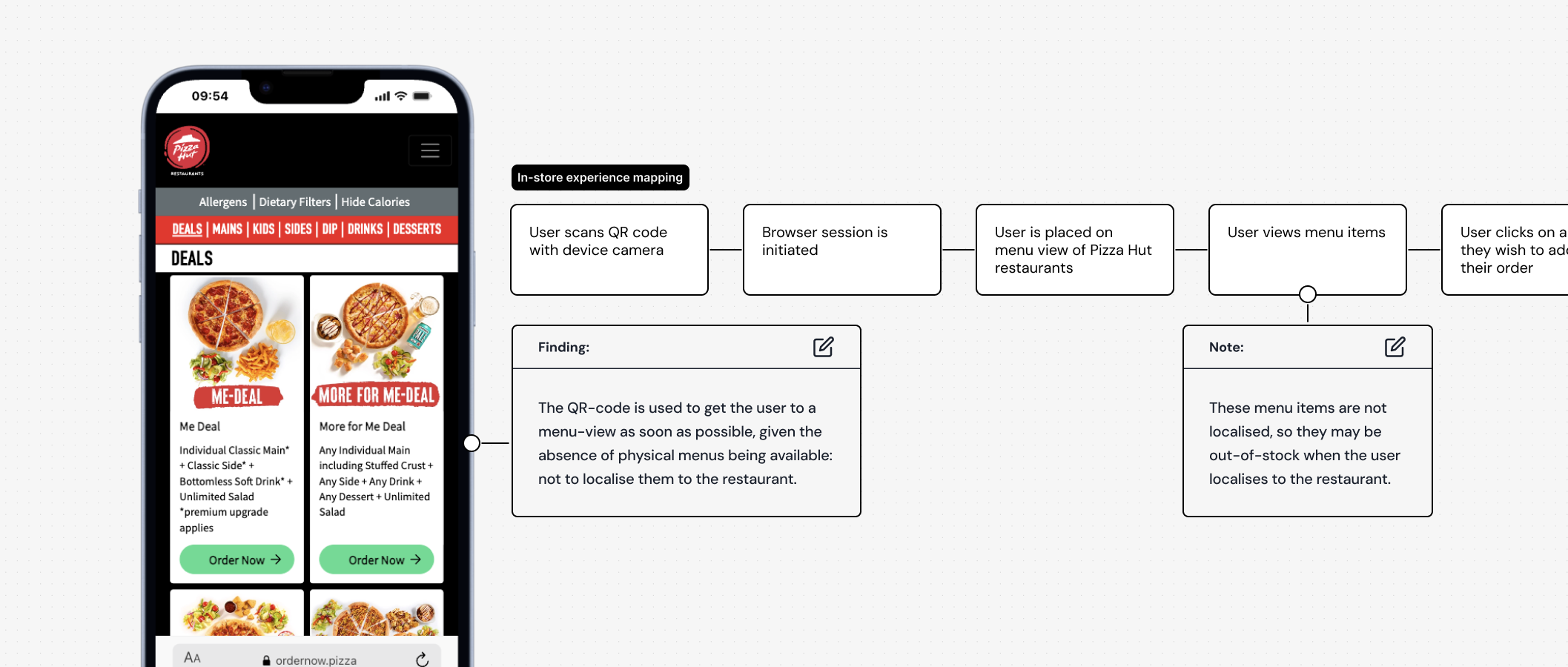

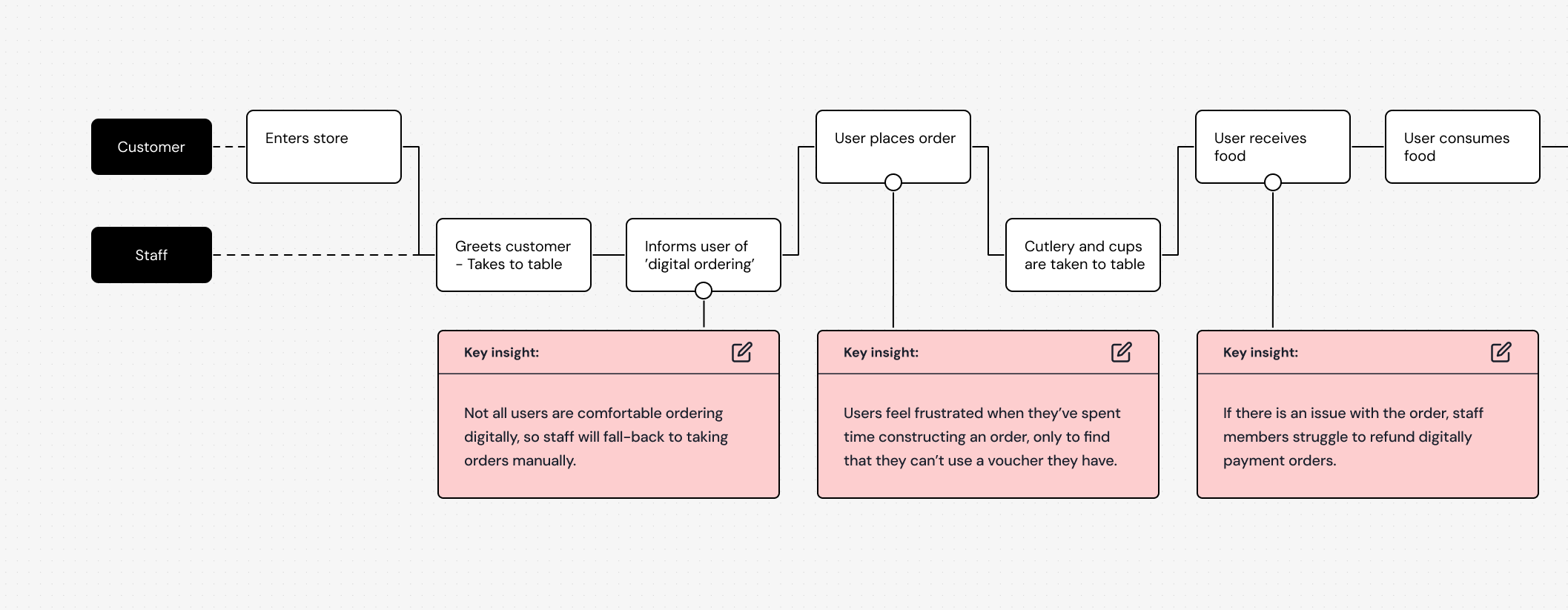

Understanding…

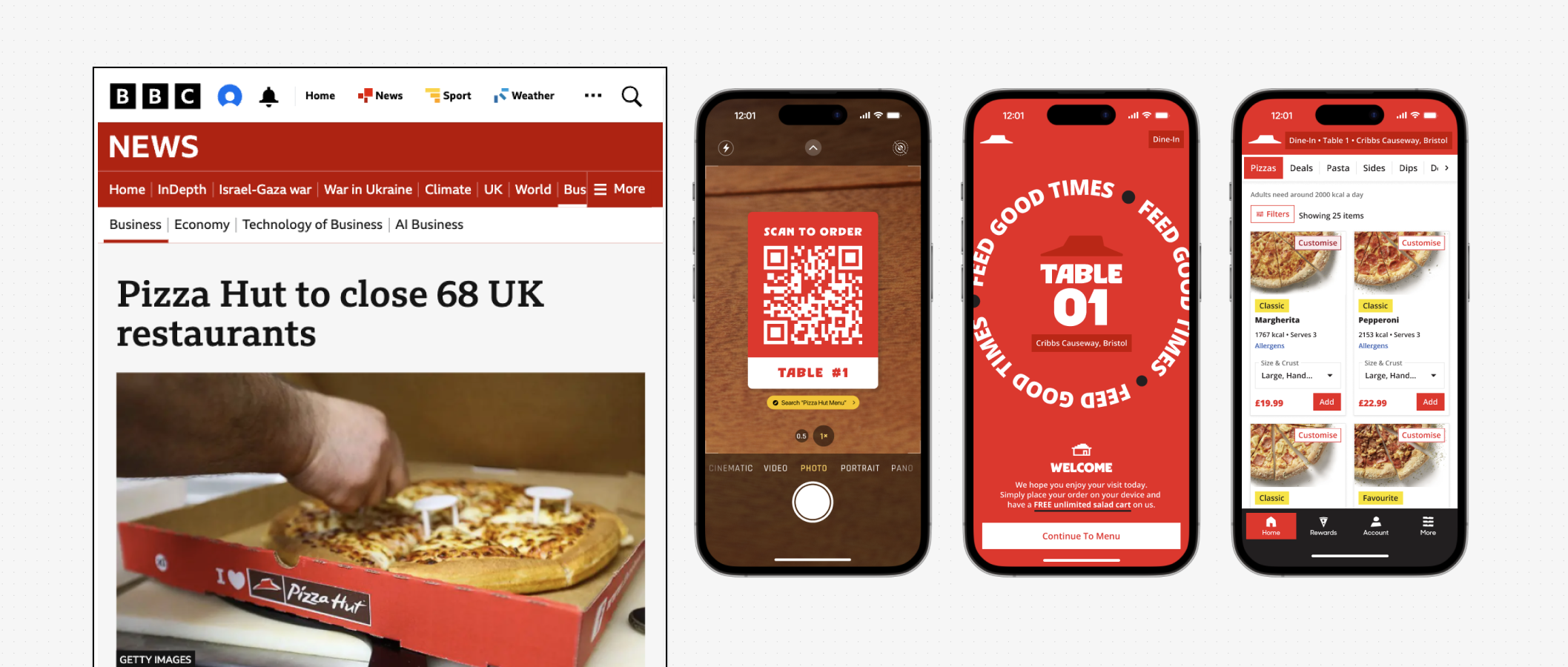

By mapping the current third-party experience, I created a foundational reference that aligned cross-functional stakeholders and served as a baseline for our competitive research.

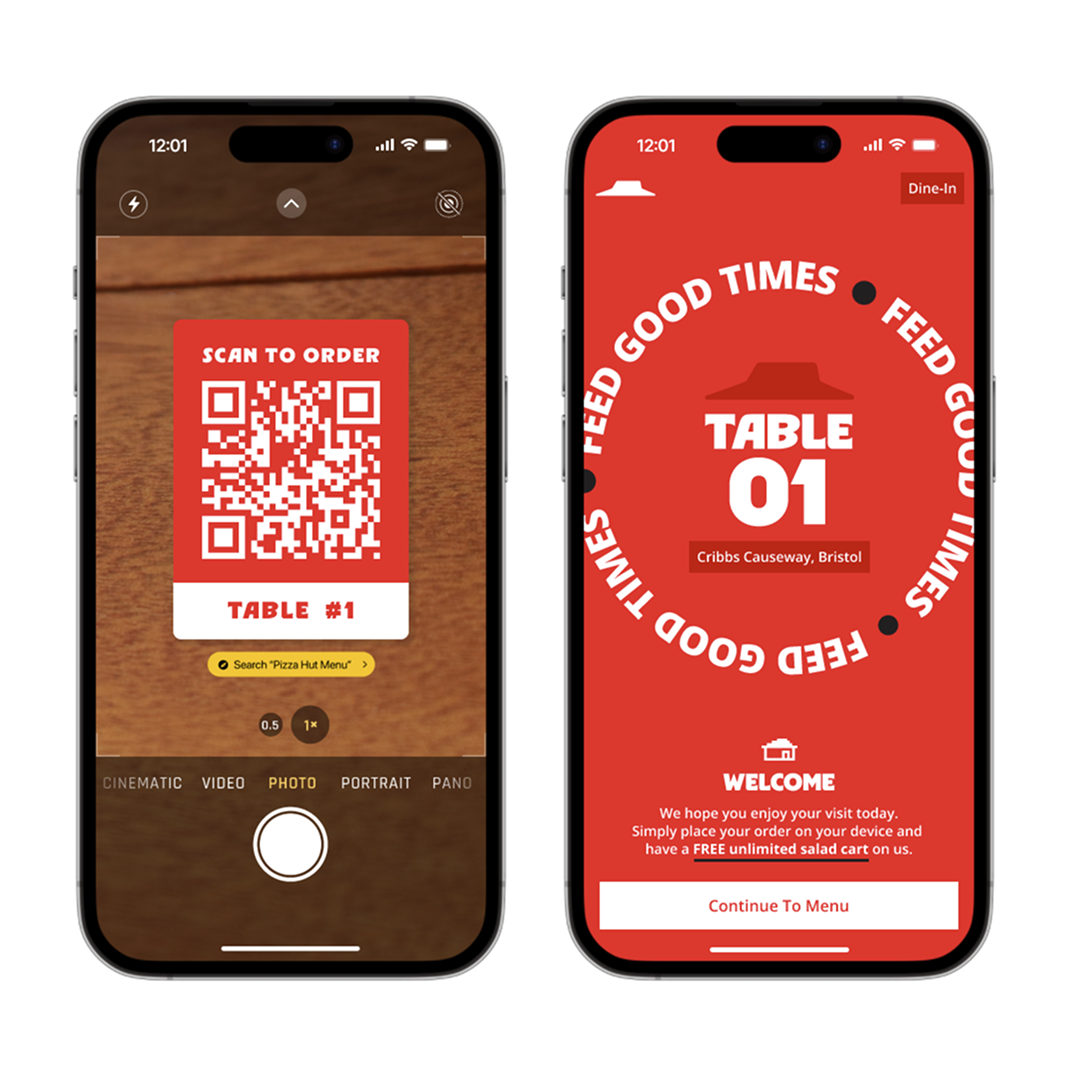

Key findings…

The localisation journey lacked cohesion. Although tables featured QR codes, they only identified the store branch rather than the specific table. This resulted in the user having to manually enter their table number upon entering the product.

The experience lacked integration with the brand’s loyalty program; consequently, points earned through online orders could not be redeemed for in-store purchases.

Analysing: Competitors

What did other digital dine-in experiences look like?

Unique situation…

Unlike delivery-focused competitors such as Domino’s, Pizza Hut maintains a significant dine-in presence in markets like the UK and US. To accurately benchmark the experience, we looked beyond Pizza Hut’s direct competitors to include a wider range of casual dining experiences.

Key findings…

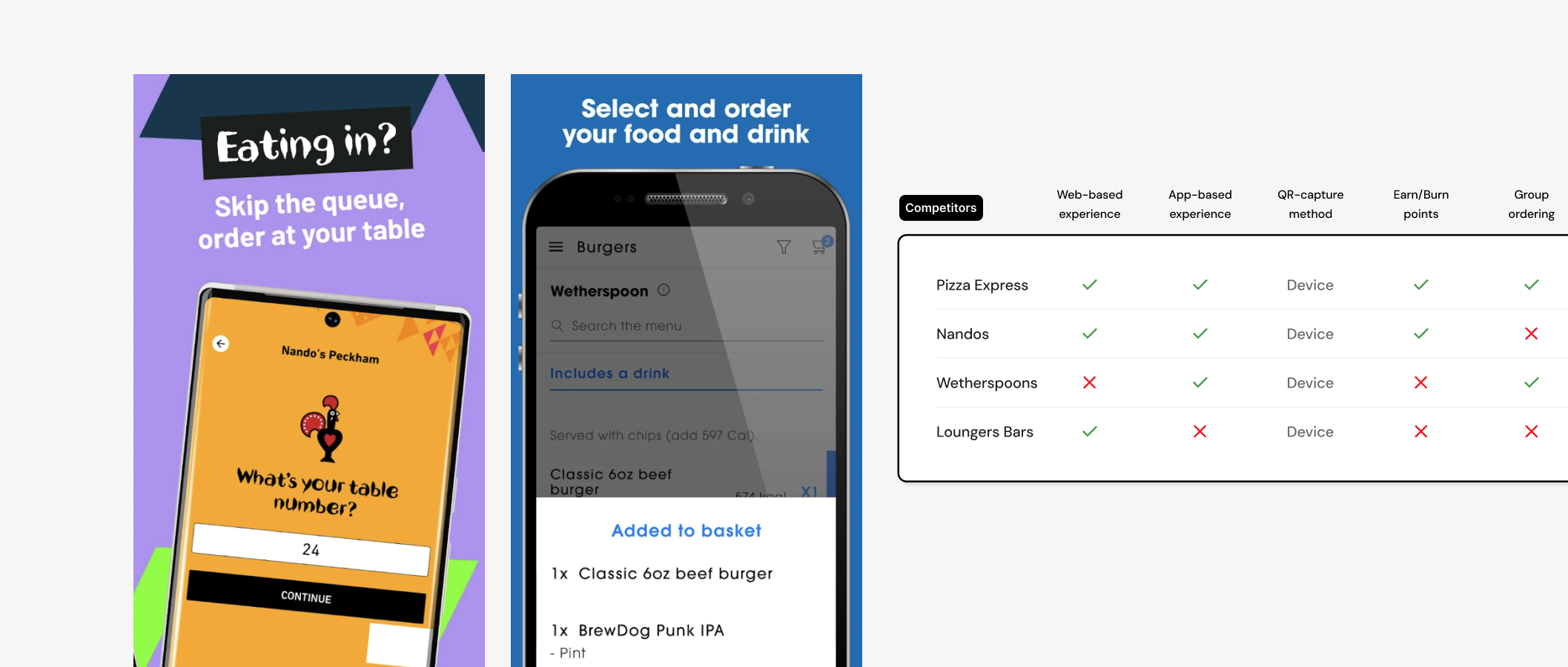

Few competitors offered a seamless, feature-complete experience across both web and mobile app platforms.

The ability to earn and redeem loyalty rewards was not yet a standard industry practice.

Several brands limited their digital offering to payment processing only, failing to provide an end-to-end digital ordering experience.

QR code scanning was typically handled via the device’s native camera, rather than being integrated directly within the brand’s app.

Points of interest…

A limited number of brands offered real-time group ordering, enabling a single order to be populated across multiple user sessions.

While split-billing was available in some instances, it was frequently a standalone feature that lacked native integration with an existing group ordering workflow.

Planning: Research activities

What parts of the experience required validation?

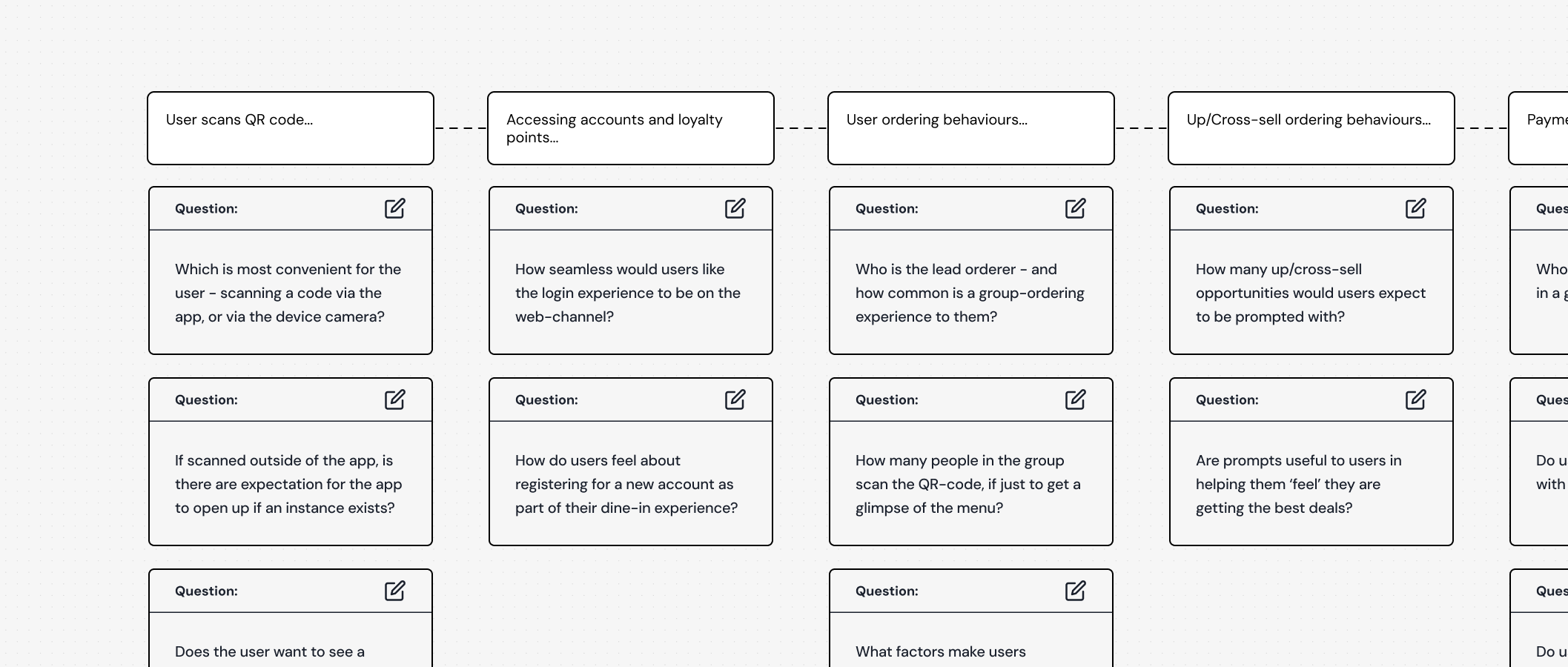

Gathering insights...

In collaboration with the research team, I complemented quantitative surveys with extensive on-site contextual inquiries across the UK. This fieldwork was critical in validating any core assumptions that could influence the product’s strategic scope.

Assumptions to validate…

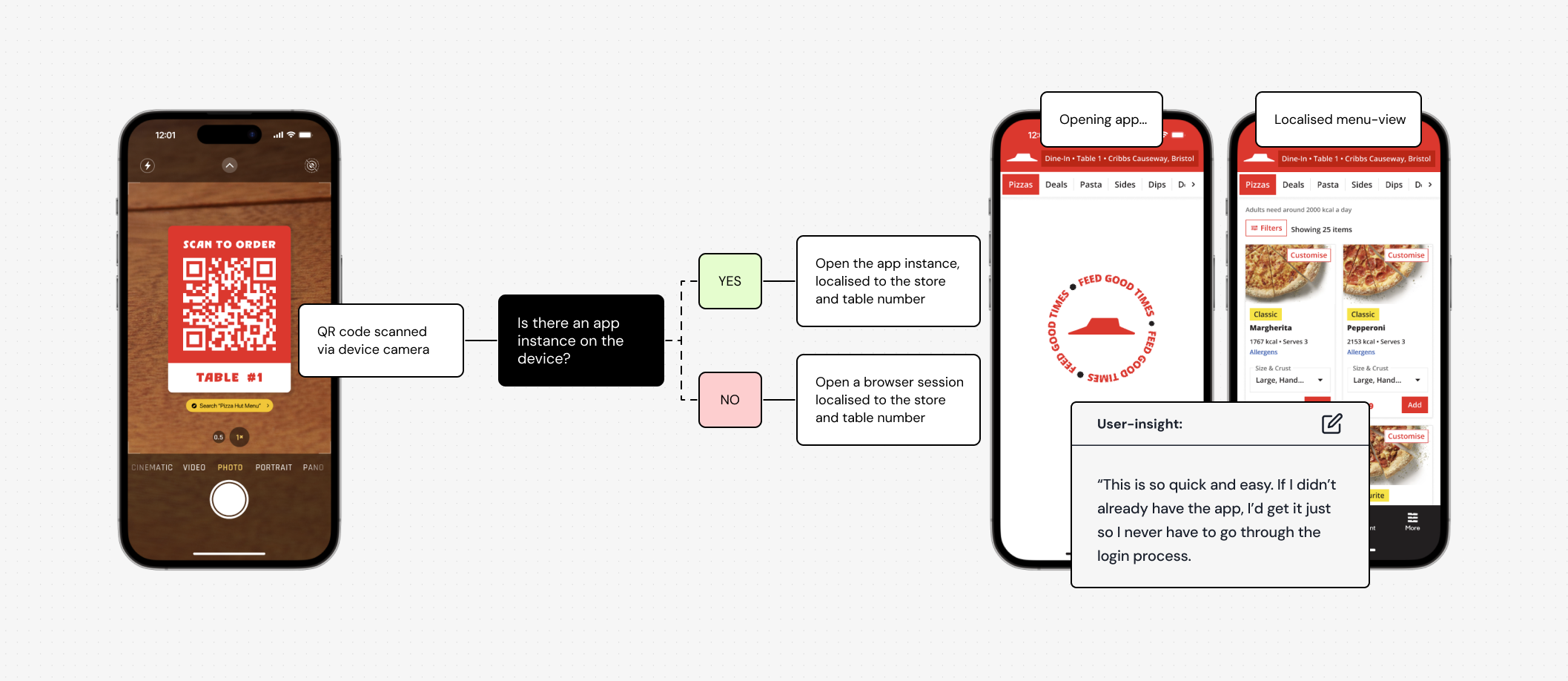

QR-code scanning - Is there an expectation for an integrated in-app scanner, or is the device’s native camera the common default starting point?

Group ordering - How often have users interacted with group ordering functionality and what scenarios does it best serve?

Split payments - If group ordering is present, do users expect split-payment functionality to naturally be part of the experience too?

Loyalty rewards - With a loyalty offering existing in today’s UK experience, do users expect to be able to use their reward points as part of their dine-in experience?

QR code scanning

Users demonstrated a strong mental model for native scanning, instinctively launching their device's camera application before engaging with the QR code.

Loyalty rewards

There was a high expectation for omnichannel parity, with users viewing loyalty redemption as a mandatory feature across all digital and physical touch-points.

Group ordering and split payments

These were identified as non-critical features, as users had already established effective manual workarounds to manage the scenarios.

Insights: From within the restaurants

Understanding the dine-in experience from an operational perspective

Front-line insights…

Beyond observing user behaviour in situ, the site visits facilitated a direct dialogue with staff. We gathered critical feedback on how the BYOD ordering service integrated with—and influenced—existing service workflows and employee productivity.

Key findings…

Loyalty - Staff confirmed that they regularly have to inform users that their loyalty rewards can’t be used in-store.

Discounts - Cineworld membership discounts are not currently supported digitally, forcing a shift from automated ordering to manual staff processing.

Refunds - When a sub-optimal experience occurs, the refund process is hindered by the constraints of the online payment model. This complexity creates a significant barrier to effective service recovery and immediate customer resolution.

Digital only stores - While some branches branded themselves as 'digital-only' establishments, manual ordering remains an active fallback. This 'manual override' allows staff to ensure service continuity and capture revenue from customers who are unable or unwilling to use the digital interface.

Scoping: The roadmap and product strategy

Shaping the experience

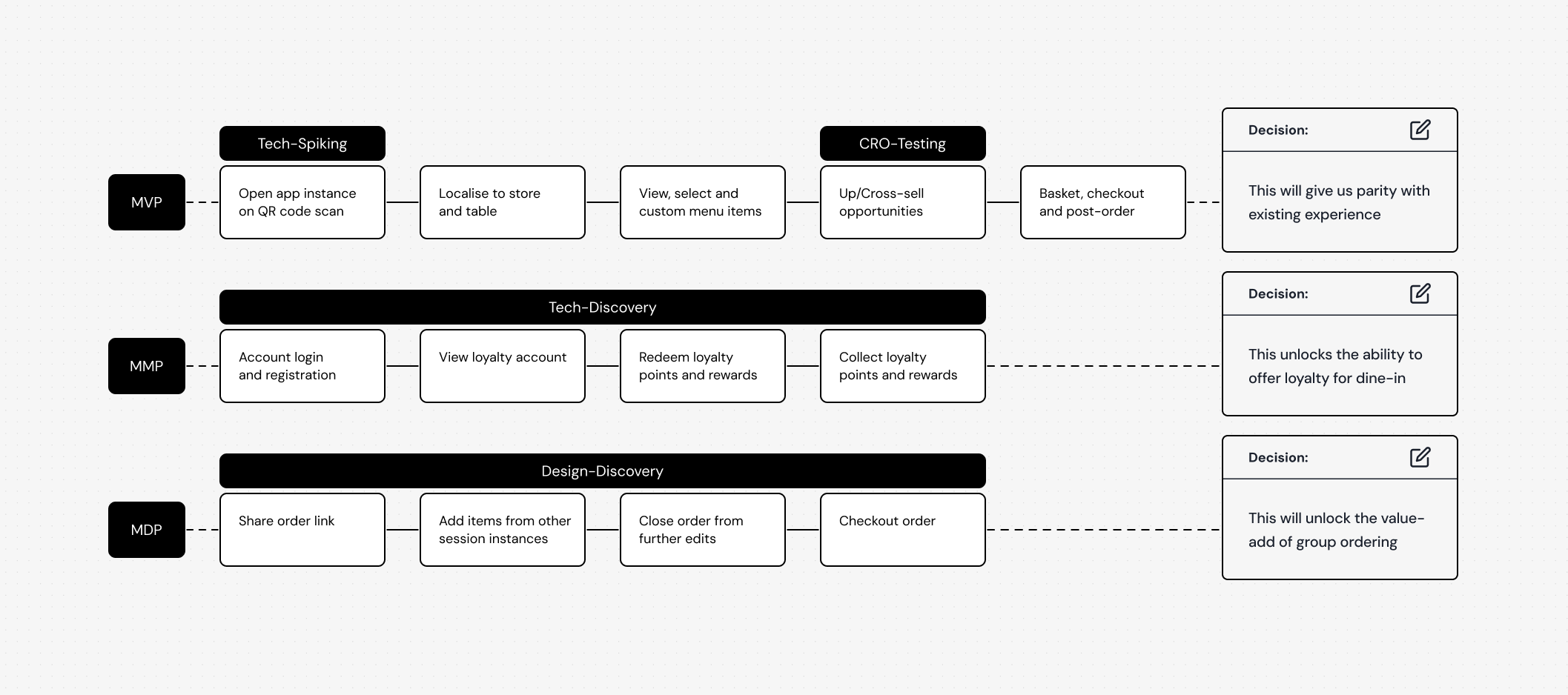

Defining the roadmap…

Partnering with the Product Manager, we then translated these insights into a strategic approach. The mapping out of a North-Star vision worked as our guide to help define the technical milestones and engineering architecture needed to bring the product to life.

Product strategy…

The following phased release strategy was structured to balance stability with new value:

Release #1 (Core and conversion): Achieve feature parity with the legacy experience while integrating a new loyalty program and key conversion optimisations.

Release #2 (Social features): Design and launch a comprehensive group-ordering flow.

Release #3 (Payment enhancement): Introduced a seamless split-bill payment experience.

Post-launch, we would treat the live product as a continuous feedback loop, using real-world data to refine subsequent features like the group-ordering experience.

Stakeholders: Managing their expectations

Proving the value of existing platform patterns

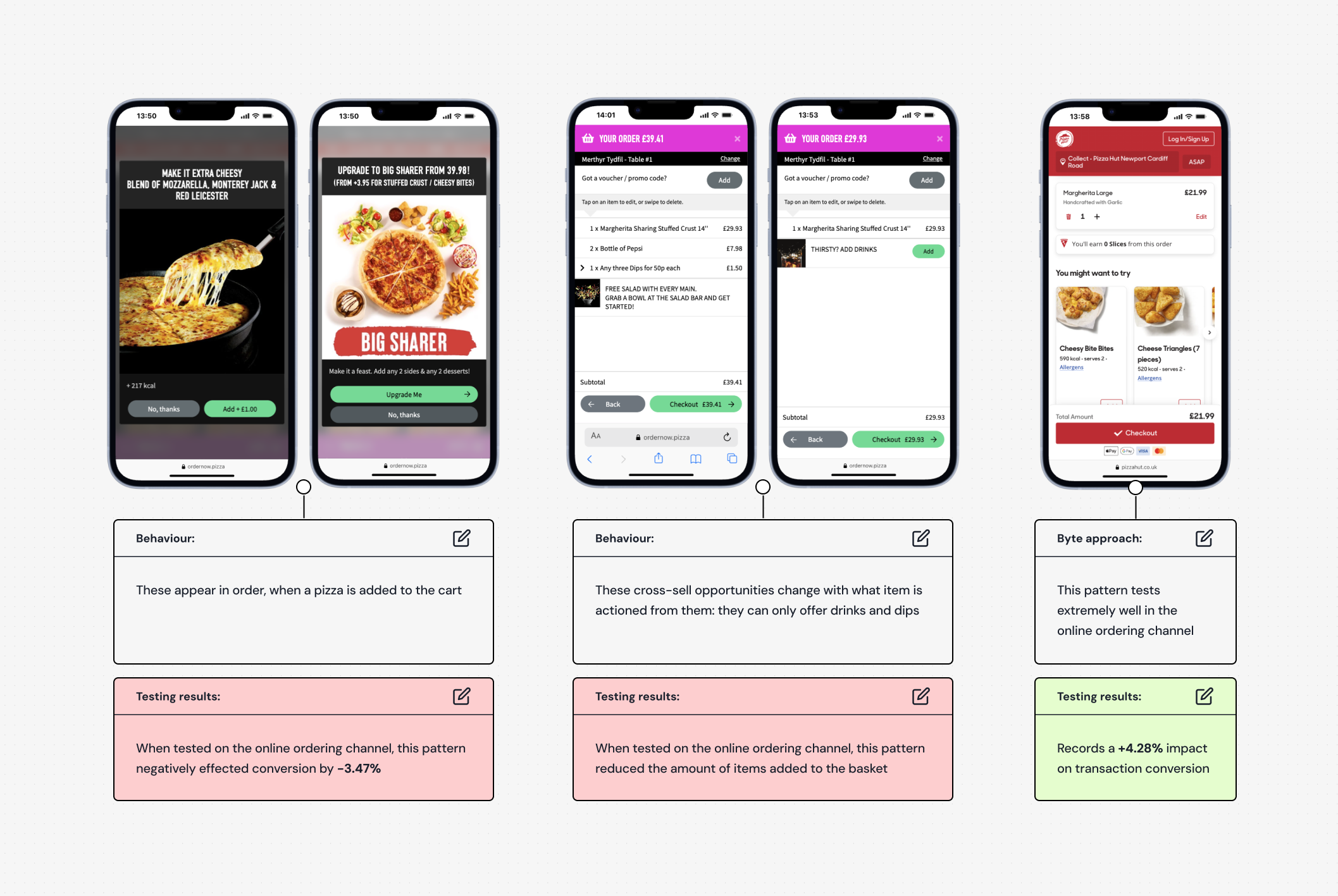

Up-sell and cross-sell opportunities…

Our platform’s up-sell approach was at odds with the market’s established approach; rather than integrating options into the basket flow as ‘choices’ for the user to act upon, it actively interrupted the user in their order creation flow.

Even though performance data linked these disturbances to lower conversion, the market was wary of losing 'sales touch-points'.

I bridged this gap by running a set of quick-turnaround site visits to A/B test the approaches. By pitching the current experience against a refined prototype, we provided the tangible evidence needed to prioritise user flow over disruptive prompts.

CRO testing…

To address market skepticism, we validated our hypothesis through a series of contextual A/B tests. By comparing the current disruptive flow with a high-fidelity prototype, we demonstrated the conversion benefits of a frictionless checkout.

Key findings…

The current frequency and implementation of pop-ups remained a pain point for users. Since most orders contain multiple items, the recurring prompts feel repetitive and lead to significant friction during the checkout process.

Enhancing the prominence of cross-sell options in the cart significantly increased user engagement, as the more visible placements successfully captured user interest.

Result…

Market stakeholders responded positively to our contextualised restaurant testing results and made the decision to align with the e-commerce platform’s experience approach.

Decisioning: Insight driven design

Ensuring user expectations were met

Differing opinions…

The development team expressed concerns regarding the technical feasibility of redirecting users to a specific app instance via QR code. Additionally, there related to uncertainty about whether this feature can be completed within the Phase.1 timeline.

Highlighting the importance…

To prevent this feature from being de-scoped, I advocated for its inclusion by presenting data-driven insights to the squad. I demonstrated that app redirection was not only a primary user expectation but also the critical gateway for unlocking our loyalty experience integration.

Outcome…

The initial hesitation was identified as a resource constraint within the app team. By partnering with the Product Manager, I helped secure the necessary prioritisation and staffing to ensure this functionality remained a core part of the first phase release.

Decisioning: Logical product planning

Enhancing the post-order experience

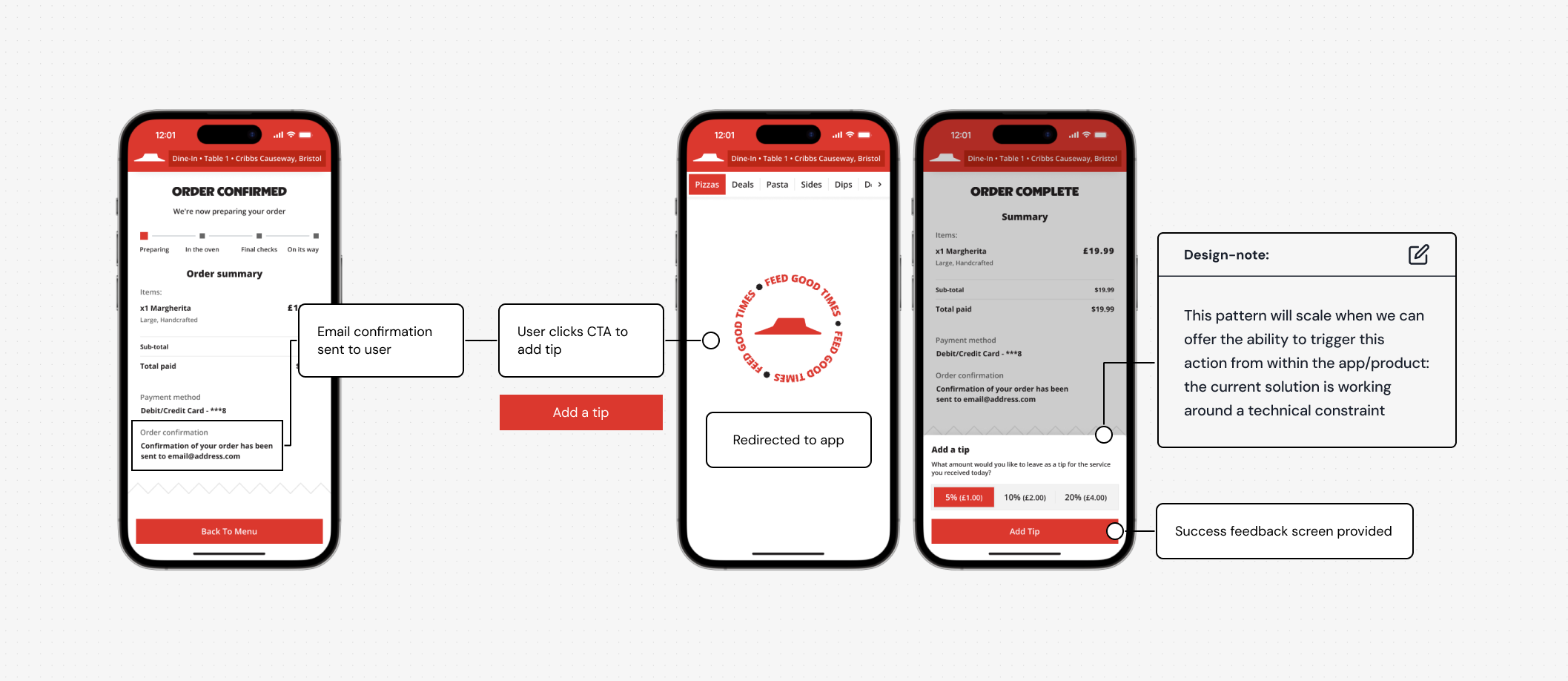

Tipping…

Unlike delivery and collection channels, staff tipping was a high-priority request for the market. While it was technically simpler to implement tipping at checkout as part of a single transaction, this 'pre-tip' model—common in the US—conflicted with UK cultural norms. Recognising this misalignment with local user expectations, I pushed for a solution that better reflected the UK’s 'service-first' tipping culture.

Outcome…

Through close collaboration with the Tech Lead, we developed a post-order tipping solution using email triggers and stored payment details. Although guest customers were excluded due to technical constraints, we successfully delivered a frictionless, secondary-transaction model for account holders that aligned with UK tipping etiquette.

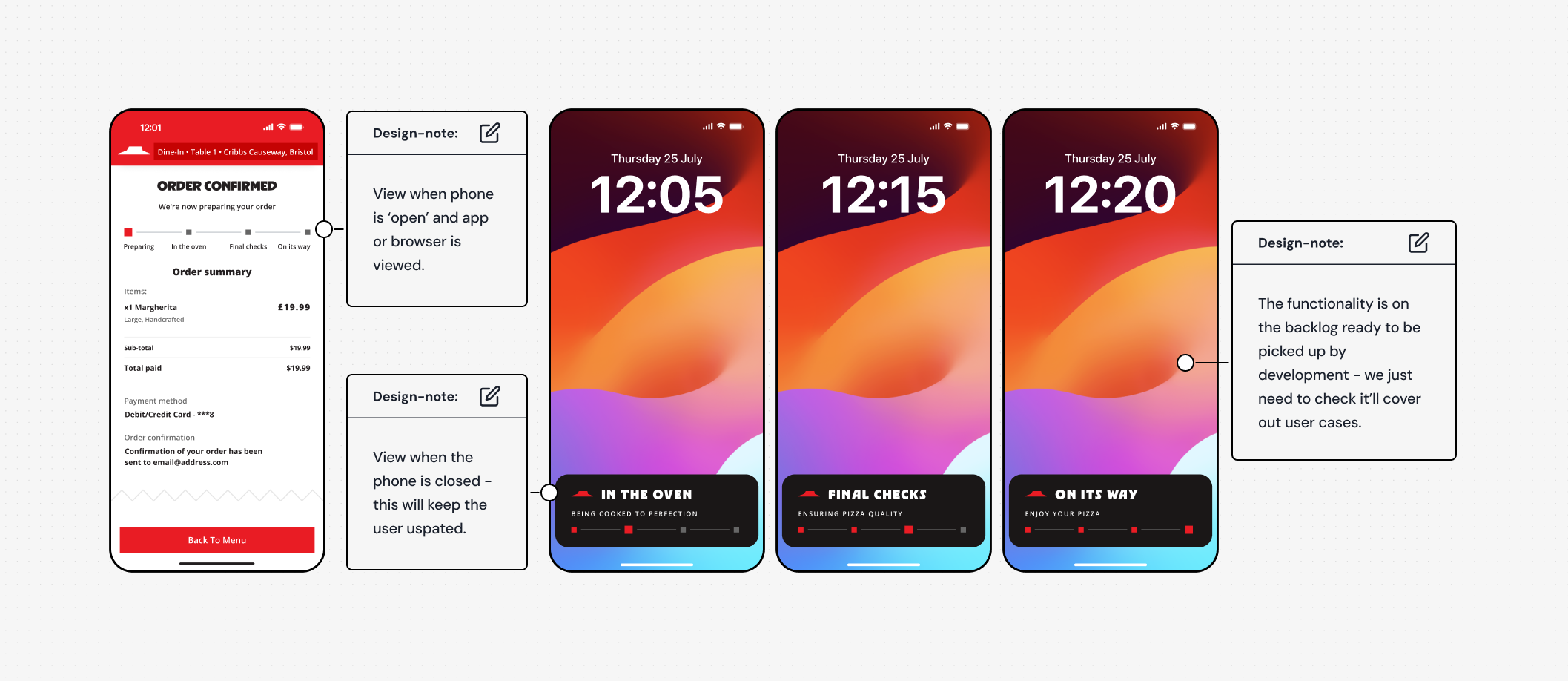

Real-time order updates…

To support the new dine-in channel, I identified an opportunity to enhance the order tracking journey by integrating a lock-screen widget that had existed on the platform’s backlog. I collaborated with engineering to prioritise this feature for Phase 1 delivery. By deciding to launch this as a 'test-and-learn' initiative, we aimed to validate user value through live engagement data rather than relying on assumptions.

Handover: Transferring knowledge

Guiding the design from a high-level perspective

Ticket definition…

With product planning complete, I then added design requirements to all relevant Jira tickets. This ensures the designer has the necessary context and rationale to drive the UI work without me over-prescribing the visual solution.

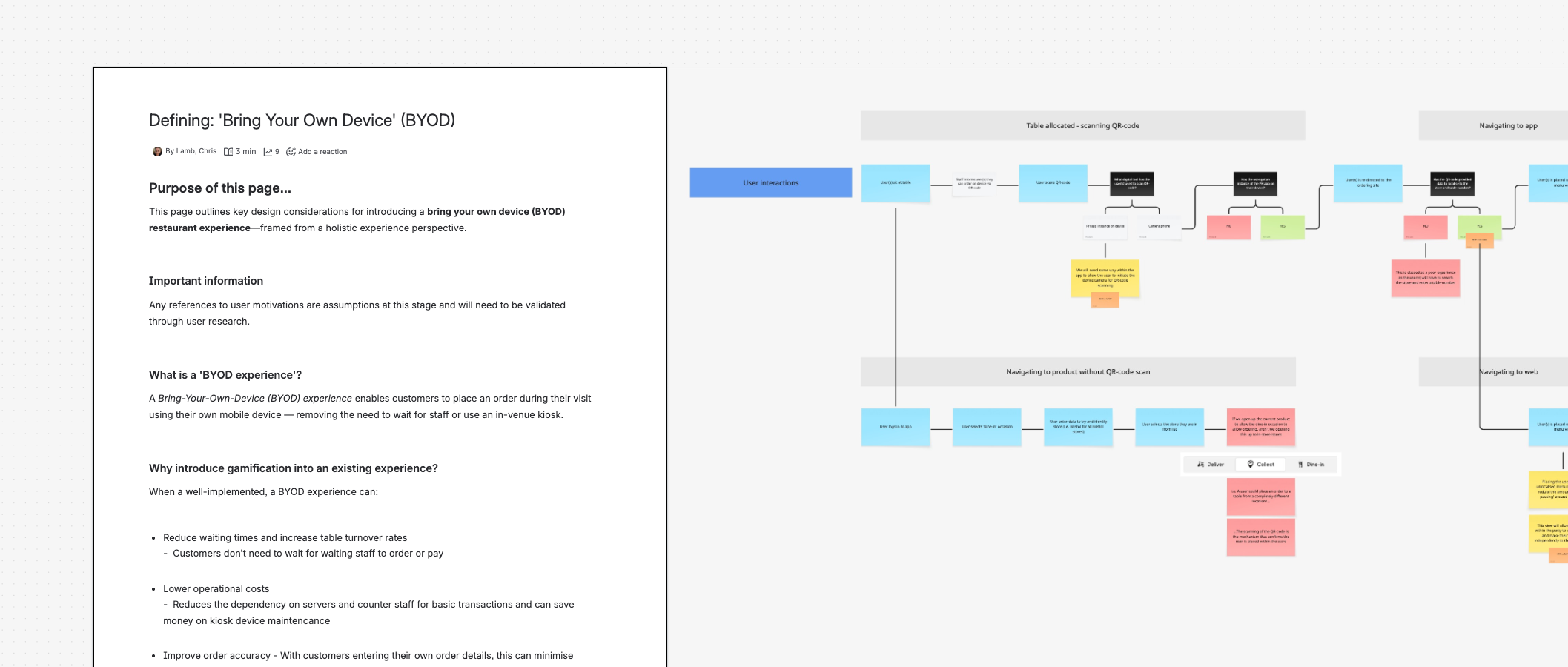

Key documentation…

To provide deeper context, I back up my Jira tickets documentation with a dedicated Confluence space containing our research and rationale. By establishing a master experience map as part of this documentation, I provide the team with a unified source of truth. This framework anchored the high-level vision and ensures that both design and product efforts are moving toward the same strategic goals.

State-of-play: Market difficulties

To be continued…

Turbulent times…

Having completed this work in Sept ‘25, it was expected that this project would be picked up for the UK market in Q4. However, with the unexpected news of 68 UK restaurants having to close in October ‘25, it is uncertain when this project work will be implemented, if at all. If and when it does, the project can still operate at the same velocity it was set to.

What we knew…

Beyond gaining stakeholder buy-in, I used research and usability testing to prove that adopting established, high-performing design patterns would unlock significant market growth.

Automated Localisation: By removing the friction of manual table entry, we aligned with user expectations and achieved a +4.89% increase in transaction conversions.

Strategic Cross-Selling: Using data-driven insights, I successfully advocated for a shift away from intrusive "crust upsells" in favour of basket-view cross-selling, which significantly improved both conversion and "items-added-to-cart" rates (+5.34%).

Optimised Flow: By streamlining the end-to-end journey, we reduced click-debt and time-to-task (-9.12 seconds). This not only created a more modern commerce experience but also improved operational efficiencies at the store level.

Reflections

Learnings I took away from the project

Data-driven stakeholder management…

Stakeholders expressed concern that our digital upsell strategy lacked the persuasive 'pitch' of a physical server. I led a move away from these unvalidated assumptions by presenting evidence of actual user expectations and conversion behaviours. By framing the discussion around data rather than opinion, I successfully influenced a transition toward a more conducive, user-centred design process that satisfied both market stakeholders and user needs.

Adding product value…

Rather than settling for experience parity, I advocated for a more ambitious product vision that addressed the 'dine-in' experience gap. I translated this opportunity into a foundational design principle, aligning cross-functional teams around a clear, user-centric North Star. This not only streamlined the design-to-development handoff but also created a scalable framework for post-launch engagement and loyalty integration.